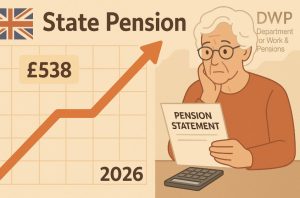

Exciting news awaits pensioners across the UK as the state pension increase in November 2025 brings a much-needed boost to retirement incomes. This significant change is part of the government's commitment to improve living standards for retirees, ensuring they can enjoy a more comfortable and secure retirement. The increase is a welcome development for millions who depend on the state pension as a vital source of income.

The upcoming state pension increase in November 2025 is not just a financial adjustment; it represents a broader shift in how the UK supports its older citizens. By addressing inflation and cost-of-living challenges, the government aims to ensure that retirees can maintain their quality of life without undue financial stress. This initiative is part of a comprehensive strategy to enhance social security and promote long-term economic stability.

Understanding the impact of this increase requires an examination of the current state pension landscape and the factors driving the need for change. The state pension, a cornerstone of the UK's social security system, is designed to provide a foundation for retirement income. However, rising costs of living and inflationary pressures have placed increased importance on these periodic adjustments. The upcoming increase in November 2025 is particularly significant as it addresses these ongoing challenges.

State Pension Increase November 2025: A Detailed Look

The state pension is a fundamental component of the UK’s social security framework, offering essential financial support for millions of retirees. The upcoming state pension increase in November 2025 is a highly anticipated development, poised to positively impact the lives of many. This increase is a response to the growing cost of living, ensuring that retirees can maintain their financial stability and quality of life.

The increase is expected to be calculated based on the triple lock, which guarantees that the pension will rise by the highest of either 2.5%, average earnings growth, or the Consumer Prices Index (CPI) inflation rate. This mechanism ensures that the state pension keeps pace with economic changes, providing a reliable source of income for retirees.

Table: State Pension Increase November 2025 Overview

| Aspect | Detail |

|---|---|

| Implementation Date | November 2025 |

| Primary Driver | Cost of Living Adjustment |

| Calculation Method | Triple Lock (CPI, Average Earnings, 2.5%) |

| Expected Impact | Improved financial stability for retirees |

Retirees can look forward to a tangible improvement in their monthly income, directly influencing their ability to cover essential expenses and enjoy leisure activities. The state pension increase in November 2025 is a testament to the government's commitment to supporting its older citizens and ensuring they can retire with dignity.

Financial experts predict that this increase will provide a significant cushion against rising costs, allowing retirees to better manage their budgets. However, it is essential for individuals to continue planning for retirement, considering supplementary sources of income and savings to complement the state pension.

Looking Ahead: Beyond the State Pension Increase November 2025

As we prepare for the state pension increase in November 2025, it is crucial to consider the broader context of retirement planning. While the state pension serves as a foundational income, supplementary sources like savings, investments, and occupational pensions play a vital role in ensuring financial security.

The government encourages individuals to take advantage of retirement planning resources and services available to them. Initiatives such as Pension Wise offer free, impartial guidance to help people make informed decisions about their retirement options. By combining the state pension increase with personal savings and investments, individuals can create a more robust financial plan for their retirement years.

The state pension increase in November 2025 marks a pivotal moment in the UK's social security landscape. It is a step forward in addressing the financial needs of retirees and reflects a commitment to enhancing their quality of life. As we look ahead, it is essential to remain proactive in planning for retirement, ensuring that we are prepared for the future.

The state pension is not just a financial benefit; it is a symbol of societal support and care for older citizens. The increase in November 2025 is a vital component of this support system, offering retirees the financial stability they deserve. As we celebrate this upcoming change, let us also remember the importance of continued planning and investment in our retirement futures.

Join the conversation about the state pension increase in November 2025 and share your thoughts on this significant development. Stay informed and prepared for the future by exploring additional resources and options available to you. Together, we can ensure a more secure and comfortable retirement for all.

For more information on the state pension increase, including detailed guidance and resources, visit the Government website.

As we embrace the upcoming state pension increase in November 2025, let us also reflect on the broader journey of retirement planning. The future is bright, and with careful planning and informed choices, we can all look forward to a secure and fulfilling retirement.